News Summary

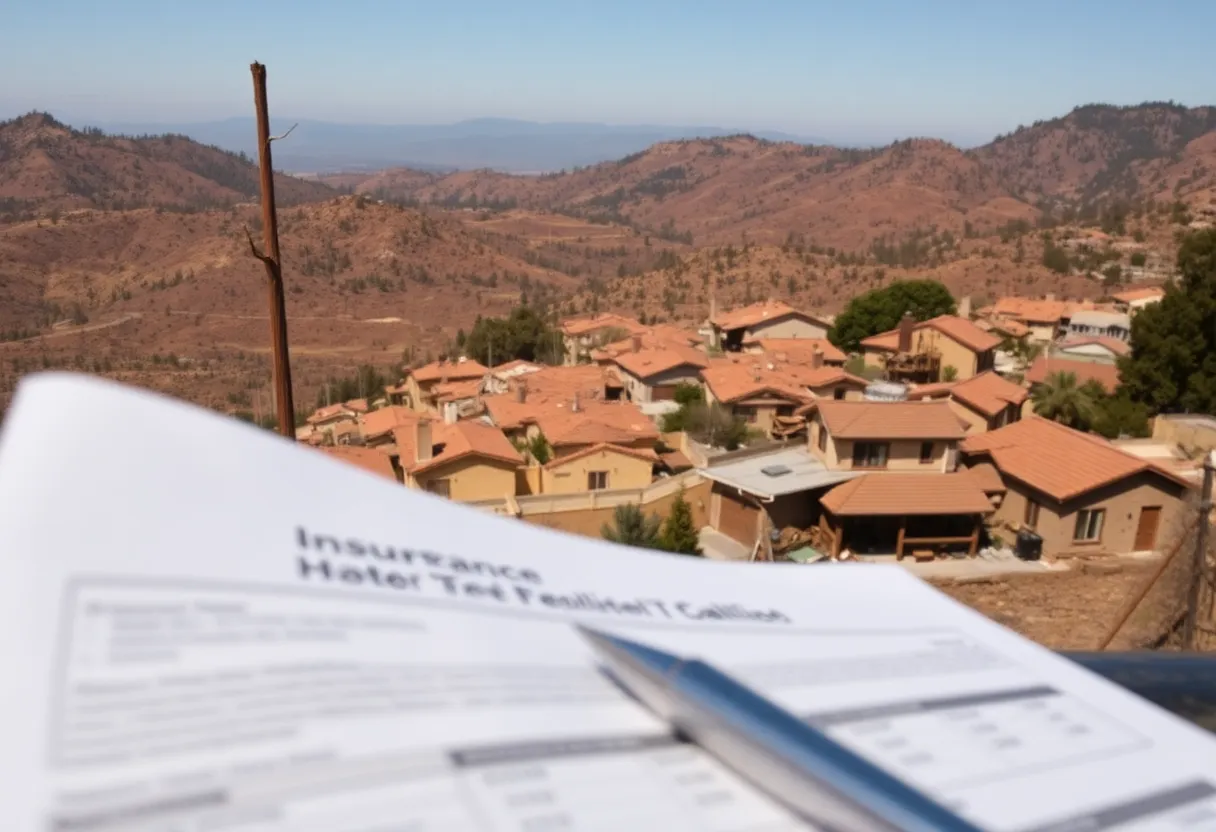

State Farm General seeks a 30% increase for homeowner insurance in California, following a 17% hike already approved. The increase, aimed at addressing financial challenges from wildfires, could raise annual premiums significantly for homeowners, condo owners, and renters. The California Department of Insurance will hold a hearing on October 20 to discuss the proposal. Consumer advocacy groups express concern over the financial burden on policyholders as the insurance landscape continues to adapt to wildfire threats.

California – State Farm General has announced plans to seek an additional 30% rate increase for homeowner insurance policies in California, significantly impacting thousands of policyholders. This move follows a recently approved 17% emergency interim rate hike and comes amidst severe financial challenges facing the insurance company.

The proposed increase aims to address what State Farm describes as “severe capital depletion” resulting from costly claims due to the destructive wildfires in Los Angeles County. Should the California Department of Insurance approve the rate increase, the average annual premium for homeowners could increase by approximately $600. Condo owners may see a rise of about $163, while renters could face increases around $30.

This call for heightened rates reflects a growing trend in the insurance sector where companies balance the need to secure their financial health while trying to avoid undue financial burden on policyholders. The California Department of Insurance has already scheduled a hearing for October 20 to review State Farm’s request thoroughly.

Background Context on Rate Increases

In the Palisades neighborhood, where State Farm holds about 70% of the market share, the company has already taken drastic steps by not renewing fire insurance for 1,626 customers. This indicates the severity of the ongoing financial situation and the lengths to which the insurer is going to avoid risk exposure in high-impact areas.

Implications for Consumers

Policyholders who have already encountered the recently approved 17% rate hike will feel the effects during their next renewal date after June 1. Should the additional 30% increase receive approval, the changes would take effect starting from customer renewals in 2026.

The proposed rate increases have sparked concerns among consumer advocacy groups, particularly Consumer Watchdog, which argues that these hikes unfairly place a heavier financial burden on policyholders. They demand greater transparency regarding the company’s financial strategies and justifications for the necessary pricing adjustments, raising questions about whether the increases are justified or excessive.

Future Considerations

California’s Deputy Insurance Commissioner, Michael Soller, highlighted that any proposed rate hikes must be carefully evaluated and justified to protect consumers from potential overburdening. The upcoming hearing will play a critical role in determining whether State Farm’s request will be approved, and how it might set a precedent for future adjustments across the insurance market.

As California continues to face the growing threat of wildfires and related disasters, the insurance landscape is evolving, necessitating adjustments that may impact not just State Farm, but all insurers operating in the state.

Deeper Dive: News & Info About This Topic

- Mercury News: State Farm Insurance Rate Hike

- Wikipedia: Insurance

- The Guardian: State Farm California Emergency Rate Hike Approval

- Google Search: State Farm Insurance California Rate Hike

- San Francisco Chronicle: State Farm Insurance Rates

- Encyclopedia Britannica: California

- New York Times: State Farm Rate Increase California

- Google News: State Farm Rate Increase California

Author: Anaheim Staff Writer

The Anaheim Staff Writer represents the experienced team at HEREAnaheim.com, your go-to source for actionable local news and information in Anaheim, Orange County, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as major conventions at the Anaheim Convention Center, including NAMM and VidCon, exciting games at Angel Stadium and Honda Center, and developments at Disneyland Resort Our coverage extends to key organizations like the Anaheim Chamber of Commerce and Visit Anaheim, plus leading businesses in hospitality, entertainment, and innovation that power the local economy As part of the broader HERE network, including HERECostaMesa.com, HEREHuntingtonBeach.com, HERESantaAna.com, and HERELosAngeles.com, we provide comprehensive, credible insights into Southern California's dynamic landscape.